Buying your first car can be exciting and overwhelming. With so many options, financing choices, and dealership tactics to navigate, new buyers often feel lost in the process.

Understanding how to approach your first car purchase can save you thousands of dollars and help you drive away with the right vehicle that fits your needs and budget.

The car-buying journey involves several critical steps that many first-timers overlook in their excitement. From determining a realistic budget to researching vehicle reliability ratings, each decision impacts your satisfaction with the purchase. These five tips will guide you through the process and help you avoid common pitfalls that plague many new car buyers.

Key Takeaways

- Setting a realistic budget that includes insurance, maintenance, and fuel costs prevents financial strain after purchase.

- Researching vehicle reliability, comparing prices, and arranging financing before visiting dealerships gives buyers stronger negotiating power.

- Taking test drives, reviewing the fine print, and considering post-purchase expenses ensures a satisfying long-term ownership experience.

Understanding Your Budget

Setting a realistic budget is the most crucial step when buying your first car. A clear financial plan helps you avoid overspending and ensures you can afford both the purchase price and ongoing costs.

Assess Your Financial Situation

Start by calculating how much money you can realistically spend on a car. Financial experts recommend spending no more than 20% of your monthly income on car-related expenses. This includes your car payment, insurance, gas, and maintenance.

Consider using the 20/4/10 rule:

- Make a 20% down payment

- Finance for 4 years or less

- Keep total car expenses under 10% of your gross income

Look at your current savings and determine how much you can put toward a down payment. A larger down payment means lower monthly payments and less interest paid over time.

Pre-approval for an auto loan helps establish your price range. Check with several lenders to find the best interest rate. Credit unions often offer lower rates than traditional banks.

Consider Additional Costs

The purchase price is just the beginning of car ownership expenses. Many first-time buyers forget to budget for these essential costs:

One-time expenses:

- Sales tax (varies by location, typically 5-10% of purchase price)

- Registration fees ($25-$250 depending on state)

- Documentation fees ($100-$400)

- Extended warranties (optional, $1,000-$3,000)

Recurring costs:

- Insurance ($1,200-$2,400 annually for new drivers)

- Fuel ($100-$200 monthly)

- Maintenance ($500-$1,000 yearly)

- Parking fees (varies by location)

Insurance costs can vary dramatically based on your age, driving record, and the car model. Get quotes before finalizing your purchase decision.

Researching Before Purchase

Thorough research is the foundation of a smart car purchase. Investing time to learn about different options will save money and prevent buyer’s remorse.

Compare Different Models

When comparing car models, focus on your actual needs rather than wants. Make a list of must-have features versus nice-to-have features to guide your search.

Look at similar vehicles across different brands. For example, if you want a compact SUV, compare the Honda CR-V, Toyota RAV4, and Mazda CX-5.

Price differences between base models and fully-loaded versions can be substantial. A mid-trim level often provides the best value, offering important features without unnecessary extras.

Pay attention to:

- Fuel economy ratings

- Cargo space measurements

- Engine performance specs

- Technology features

- Warranty coverage

Online comparison tools like Edmunds, Cars.com, and TrueCar allow side-by-side model comparisons with detailed specifications.

Read Reviews and Ratings

Professional reviews from automotive journalists provide expert insights on handling, comfort, and performance. Consumer Reports offers detailed reliability data based on actual owner experiences.

Owner reviews reveal real-world problems that might not appear during test drives. Look for patterns in complaints rather than focusing on isolated issues.

J.D. Power ratings measure initial quality and long-term dependability. These scores help identify models with fewer problems than average.

YouTube video reviews can show features in action and highlight potential issues. Channels like Car and Driver and MotorTrend offer professional assessments with real-world testing.

Join online forums specific to models you’re considering. Current owners often share maintenance costs and common problems that dealers rarely mention.

Safety and Reliability Considerations

Safety features should be a top priority for first-time buyers. Look for these key safety technologies:

- Automatic emergency braking

- Lane departure warning

- Blind spot monitoring

- Adaptive cruise control

- Multiple airbags

Check crash test ratings from the National Highway Traffic Safety Administration (NHTSA) and Insurance Institute for Highway Safety (IIHS). Five-star NHTSA ratings and IIHS “Top Safety Pick” designations indicate superior protection.

Reliability directly affects long-term ownership costs. Japanese brands like Toyota and Honda typically rank high for reliability, but individual models can vary.

Research the cost of common repairs and maintenance for specific models. Some cars require premium fuel or specialized parts that increase ownership expenses.

Insurance companies charge different rates based on safety records and repair costs. Get insurance quotes before finalizing a purchase to avoid budget surprises.

Financing Your Car

Securing the right financing can save you thousands of dollars on your first car purchase. Understanding your options and planning ahead will put you in a stronger position to negotiate and avoid costly mistakes.

Understand Loan Options

Banks, credit unions, and online lenders offer different auto loans with varying terms. Credit unions typically provide lower interest rates than traditional banks, sometimes by 1-2 percentage points.

Online lenders offer convenience but may have higher rates for borrowers with less-than-perfect credit. The dealership financing might seem convenient, but it’s rarely the most cost-effective option.

Common Loan Types:

- Direct lending (from a financial institution)

- Dealership financing

- Buy-here-pay-here financing (for those with poor credit)

Before applying, check your credit score. A score above 700 will qualify you for the best rates, potentially saving you hundreds or thousands over the loan term.

Decide on Loan Terms

Loan terms typically range from 36 to 72 months. Shorter terms mean higher monthly payments but less interest paid overall.

Example: $20,000 loan at 4% interest

| Term Length | Monthly Payment | Total Interest Paid |

|---|---|---|

| 36 months | $590 | $1,240 |

| 60 months | $368 | $2,080 |

| 72 months | $313 | $2,536 |

Experts recommend keeping your car payment below 15% of your monthly take-home pay. Include insurance and maintenance costs in your budget calculations.

Avoid extremely long loan terms (over 60 months) if possible. Cars depreciate quickly, and longer terms can leave you “underwater” – owing more than the car is worth.

Consider Pre-financing Before Dealership

Getting pre-approved for a loan before visiting dealerships gives you significant advantages. It sets a clear budget and strengthens your negotiating position.

Walk into the dealership knowing exactly how much you can spend. This helps you focus on the car’s price rather than monthly payments, a tactic salespeople use to hide the total cost.

Pre-approval benefits:

- Establishes a firm budget

- Simplifies negotiations

- Reveals your real interest rate

- Protects from dealership financing tricks

Shop around for rates. Even a 1% difference in interest rate on a $25,000 loan can save you over $700 over 5 years.

Remember that dealerships often mark up the interest rate they offer compared to what you qualify for directly from lenders. This “dealer reserve” typically adds 1-2% to your rate.

The Dealership Experience

Visiting a car dealership can be both exciting and overwhelming for first-time buyers. Understanding how to navigate this environment will help you secure the best deal and ensure you drive away with the right vehicle for your needs.

Negotiate the Price

Always research vehicle prices before stepping onto the dealership lot. Check websites like Kelly Blue Book, Edmunds, or TrueCar to understand the fair market value of your chosen model.

Tips for effective negotiation:

- Focus on the “out-the-door” price rather than monthly payments

- Be prepared to walk away if the deal isn’t right

- Negotiate one thing at a time (price, trade-in, financing)

- Ask about dealer incentives and rebates

Bring printouts of competitor prices as leverage. Remember that salespeople expect negotiation, so don’t accept the first offer. Remain polite but firm throughout the process.

Many dealers have more flexibility at month-end or quarter-end when they’re trying to meet sales targets.

Take a Thorough Test Drive

A proper test drive should last at least 30 minutes and include various driving conditions. This helps identify any potential issues with the vehicle before purchase.

During your test drive:

- Test highway speeds and acceleration

- Drive on both smooth roads and rougher surfaces

- Try parking and maneuvering in tight spaces

- Test all features (climate control, audio, etc.)

- Evaluate comfort during longer driving periods

Ask if you can take the vehicle to a trusted mechanic for inspection. This small investment could save thousands in potential repair costs later.

Pay attention to how the car handles and feels. Trust your instincts—if something seems off, it probably is.

Review and Confirm Final Paperwork

Before signing anything, carefully examine all documents. Dealerships sometimes add unnecessary fees or extended warranties that increase the final price.

Important documents to review:

- Purchase agreement

- Financing terms (if applicable)

- Warranty information

- Vehicle history report

Verify that all verbal promises made during negotiations appear in writing. Don’t feel rushed—take your time to read the fine print.

If something doesn’t match what was discussed, politely ask for clarification or correction. You’re not obligated to sign until you’re completely satisfied with all terms.

Watch for add-ons like paint protection, gap insurance, or extended warranties that may be available elsewhere for less.

Post-Purchase Considerations

Buying a car is just the beginning of your ownership journey. After driving off the lot, there are ongoing responsibilities that require attention and planning.

Car Insurance

Getting proper car insurance is a legal requirement and financial safeguard. New car owners should shop around for quotes from multiple insurance providers to find the best coverage at competitive rates.

Insurance costs vary based on several factors:

- Your driving history

- The car’s make and model

- Your location

- Your age and credit score

Consider getting comprehensive coverage for new vehicles rather than just the minimum liability insurance. This protects against theft, vandalism, and natural disasters.

Many insurers offer discounts for safety features, good driving records, or bundling policies. Ask about these potential savings when getting quotes.

Remember to review your policy annually. As your car ages, you might adjust coverage levels to match its decreasing value.

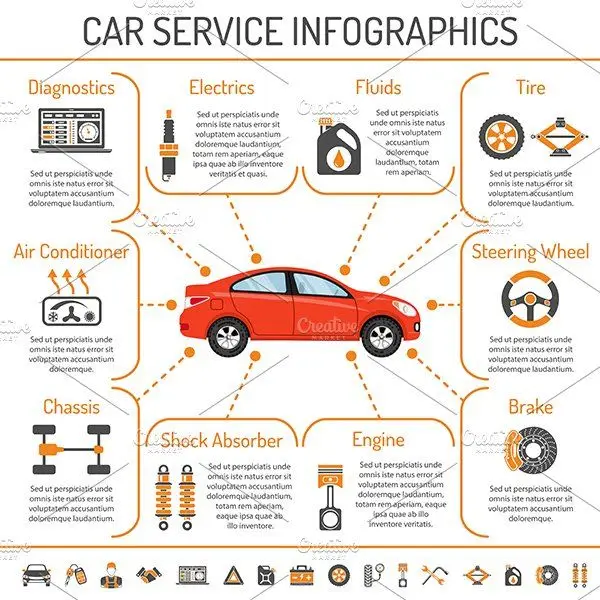

Scheduled Maintenance

Following your vehicle’s maintenance schedule is crucial for reliability and longevity. The owner’s manual contains a detailed maintenance timeline specific to your car model.

Regular maintenance typically includes:

- Oil changes: Usually every 5,000-7,500 miles

- Tire rotations: Every 6,000-8,000 miles

- Brake inspections: At least annually

- Fluid checks: Transmission, brake, and coolant fluids

Many new cars come with free maintenance for the first few years. Make sure to use these services if offered.

Keep detailed records of all maintenance performed. This documentation helps with warranty claims and increases resale value when you decide to sell.

Consider setting aside a small monthly amount for future repairs. Even reliable vehicles eventually need maintenance beyond routine service.