Introduction to Car Leasing

Car leasing is a vehicle financing option that allows consumers to obtain a car for a specified period without the financial commitment typically associated with purchasing a vehicle. Unlike buying a car, where the buyer pays the full purchase price upfront or through a loan, leasing provides the flexibility to drive a new vehicle for a predetermined time, usually between two to four years, at a fraction of the vehicle’s cost. At the end of the lease term, the lessee typically has the option to purchase the vehicle, return it, or even renew the lease.

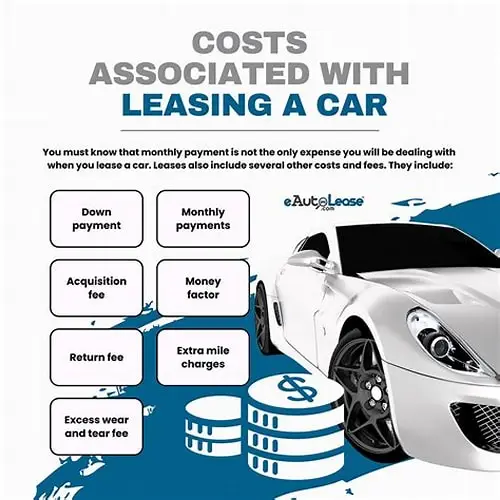

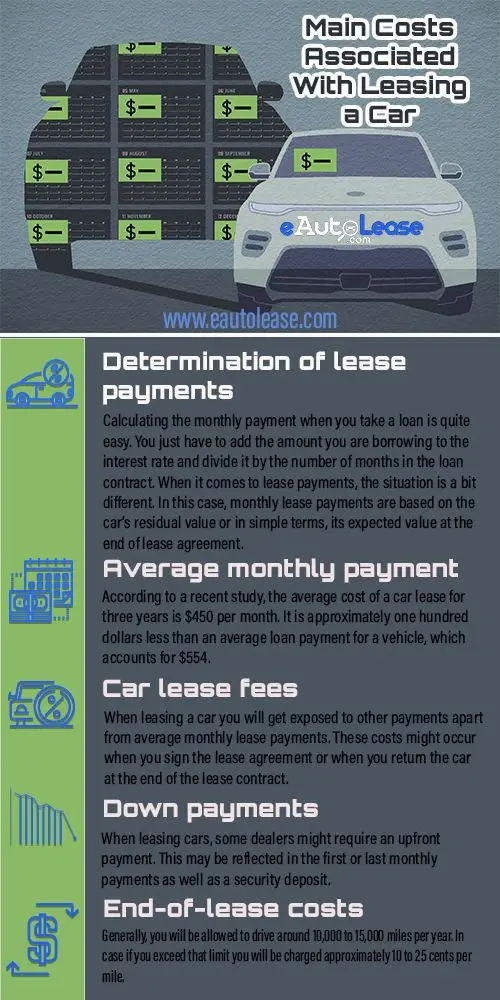

The mechanics of car leasing involve several key components, including monthly payments, lease terms, and mileage limits. Monthly payments are generally lower than car finance payments because the customer is only paying for the vehicle’s depreciation during the lease term, along with interest and any applicable fees. This can make leasing an attractive option for many consumers who are looking to drive a newer model with the latest technology without committing to a purchase.

Furthermore, vehicle leasing often comes with maintenance benefits, as many leases include warranty coverage, hygiene checkups, and sometimes even tire rotation services, which can alleviate financial concerns regarding maintenance costs. Another significant advantage of leasing is the flexibility to choose a different car every few years, which is appealing for individuals who enjoy driving the latest models or require specific features and capabilities that change frequently.

In conclusion, understanding the fundamentals of car leasing, including its differences from purchasing and the basic mechanics behind it, provides insight into why this financing option appeals to a broad audience. With its lower monthly payments and access to newer vehicles, car leasing remains a popular choice for those looking to manage their transportation needs efficiently.

The Evolution of Car Leasing: A Brief History

The concept of car leasing emerged in the post-World War II era as an innovative solution to the increasing demand for personal vehicles. Initially, leasing options were limited and primarily catered to businesses needing fleets. However, as consumer preferences shifted towards more flexible ownership solutions in the 1960s and 1970s, the vehicle leasing market began to expand significantly. This period marked the initial growth of car finance options that allowed individuals to obtain vehicles without the full financial burden of purchasing outright.

The evolution of car leasing continued throughout the late 20th century, characterized by a broader acceptance of leasing as a viable alternative to traditional financing. In the 1980s and 1990s, the introduction of standardized leasing contracts contributed to a clearer understanding among consumers. This facilitated the popularity of leasing among everyday drivers, who appreciated the possibility of upgrading to newer models every few years without the long-term commitment of ownership.

The turn of the century saw the rise of technology and the internet, which transformed the landscape of car leasing. Online platforms emerged, offering consumers the convenience of comparing leasing options from various dealerships, thus enhancing transparency and competition in the market. Additionally, advancements in automotive technology provided more lease choices, including hybrid and electric vehicles, by 2025.

As we moved into the 2020s, it became evident that changing consumer behaviors, prioritizing sustainability and economic flexibility, played an influential role in the leasing market. The increased reliance on subscription services and a greater focus on electric vehicle leasing reflects the subsequent evolution in consumer preferences towards environmentally friendly options. Thus, the landscape of car leasing continues to adapt, guided by both historical trends and current technological advancements.

Current Trends in Car Leasing (2025 Edition)

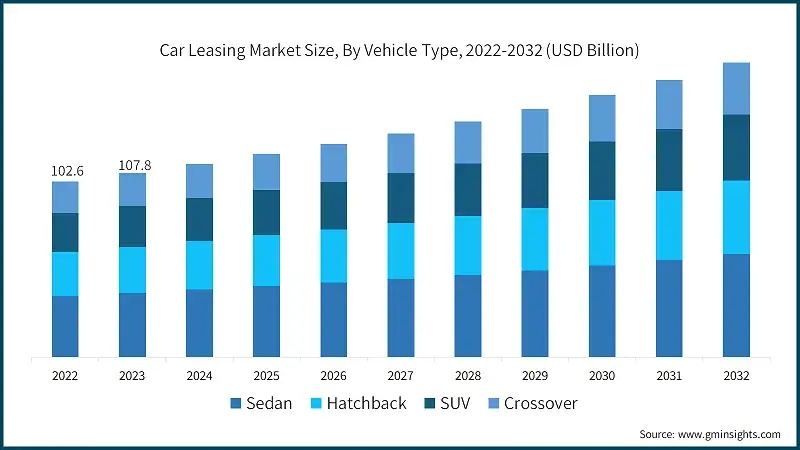

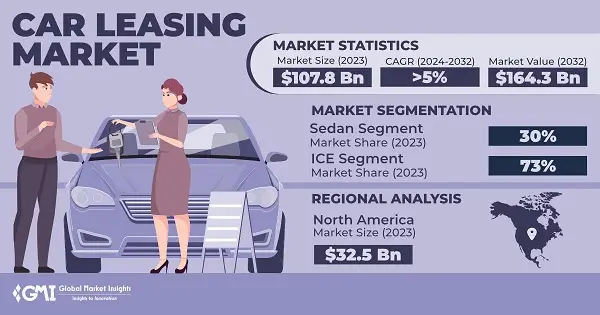

The car leasing market in 2025 is witnessing significant trends shaped by various factors, including economic conditions, the rise of electric vehicles, and changing consumer behaviors. As more individuals shift towards leasing rather than purchasing, the industry is adapting to these demands with innovative leasing programs and agreements aimed at enhancing the consumer experience.

One of the defining trends in car leasing is the surge in electric vehicle (EV) offerings. As environmental awareness increases, consumers are showing a strong preference for eco-friendly alternatives. According to recent studies, approximately 40% of new vehicle leases in 2025 involve electric or hybrid models. This shift stems from government incentives, a growing network of charging infrastructure, and heightened fuel efficiency awareness. Vehicle leasing companies are responding by refining their fleets to include more electric options, thus encouraging a sustainable driving approach.

Additionally, economic conditions play a crucial role in the evolution of car finance solutions. The rising interest rates and inflation concerns have prompted consumers to rethink their financial commitments. Consequently, leasing has become more appealing due to lower monthly payments and the avoidance of long-term debt associated with purchasing. This inclination is further reflected in the statistics, showing that lease agreements have increased by 15% over the past year.

Moreover, advances in technology are reshaping the leasing landscape. The integration of digital platforms facilitates streamlined application processes, enabling consumers to compare vehicle leasing options effectively. Enhanced data analytics are allowing companies to tailor their offerings to suit consumer preferences more accurately, promoting a more personalized leasing experience.

In conclusion, the trends in car leasing for 2025 indicate a formidable shift towards sustainability, financial prudence, and technological enhancement. These factors collectively underscore the evolving landscape of vehicle leasing and its growing relevance in the automotive market.

Benefits of Leasing a Car in 2025

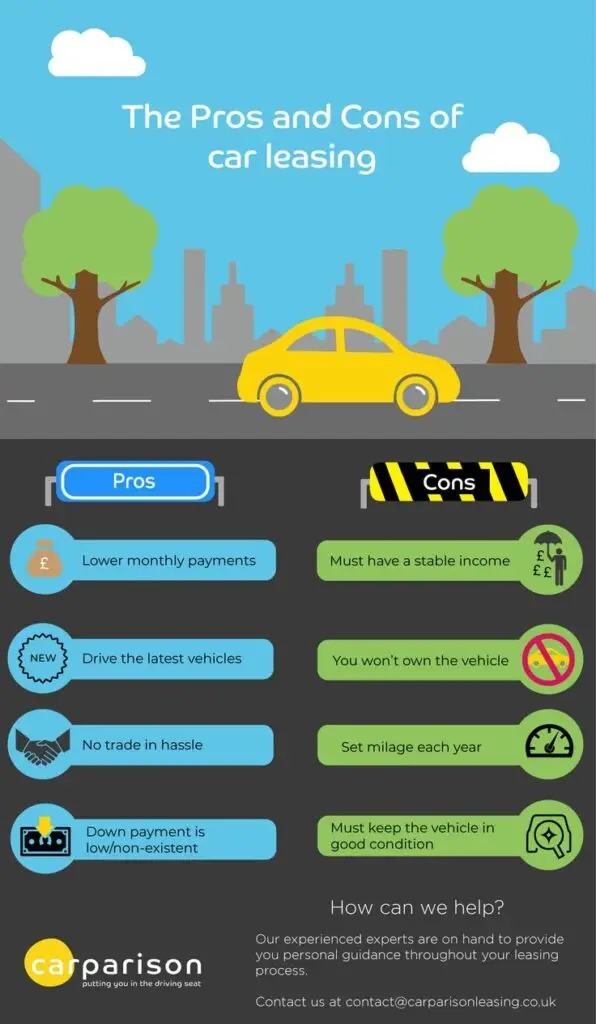

As we enter 2025, car leasing is becoming an increasingly attractive option for consumers looking to drive the latest models without the long-term commitment of purchasing a vehicle. One of the primary benefits of car leasing is the financial advantage it offers. Typically, lease payments are lower than loan payments for new vehicles, allowing drivers to allocate their budgets more efficiently. This lower monthly payment can provide substantial savings, making it easier for individuals to afford more premium or technologically advanced vehicles than they might have been able to if they were considering car finance options.

In addition to lower payments, leasing a vehicle often comes with significant tax benefits. Many regions allow lessees to deduct a portion of their lease payments from their taxable income, which can further enhance the financial appeal of leasing. Furthermore, because leases are generally shorter in duration, individuals can enjoy the peace of mind that comes from driving a new car every few years without worrying about depreciation and resale value, which can be significant burdens for car owners.

Beyond the financial considerations, there are notable non-financial benefits associated with vehicle leasing. Leasing provides access to the newest models equipped with cutting-edge technology and safety features, which is particularly important in an era where automotive advancements are rapid. This access allows drivers to stay up-to-date with the latest industry innovations and trends. Moreover, car leasing usually covers routine maintenance, which can be a substantial cost when owning. The flexibility of leasing also allows individuals to change vehicles more frequently, ensuring that they drive a model that suits their current lifestyle and needs.

All these factors combined make leasing a prudent choice for many modern consumers as they navigate the growing complexities of vehicle ownership in 2025.

Challenges and Considerations in Car Leasing

Leasing a vehicle can provide numerous advantages, such as lower monthly payments and access to the latest models. However, potential lessees must navigate various challenges and considerations when engaging in car leasing agreements. A primary concern is the mileage limit typically imposed by leasing companies. These limits, often set between 10,000 to 15,000 miles per year, can result in substantial fees if exceeded. It is vital for consumers to accurately assess their driving habits before entering into a lease to avoid unexpected costs associated with exceeding these mileage caps.

Another critical aspect of vehicle leasing involves the condition of the car upon its return. Leasing agreements usually contain clauses regarding wear and tear, which can lead to additional charges if the vehicle is deemed to be in worse condition than what is considered normal. Lessees should pay attention to the car’s upkeep during the lease term, as excessive wear, scratches, or damage could incur significant fees at the end of the lease. Understanding what constitutes “ordinary wear and tear” is essential, and lessees may benefit from documenting the car’s condition periodically throughout the lease.

Early termination of a lease can also pose challenges, often leading to penalties and fees that can be financially burdensome. Depending on the leasing company’s policies, terminating a lease prematurely may obligate the lessee to pay the remaining balance of the lease. Consumers should thoroughly review the terms outlined in their car finance agreements to comprehend the implications of such scenarios. To mitigate these risks, potential lessees are encouraged to select a leasing plan that aligns with their driving habits and financial situation, as well as to maintain open communication with the leasing company regarding any concerns that may arise during the lease period. By being informed and prepared, consumers can navigate the complexities of vehicle leasing more effectively.

Understanding Lease Terms and Conditions

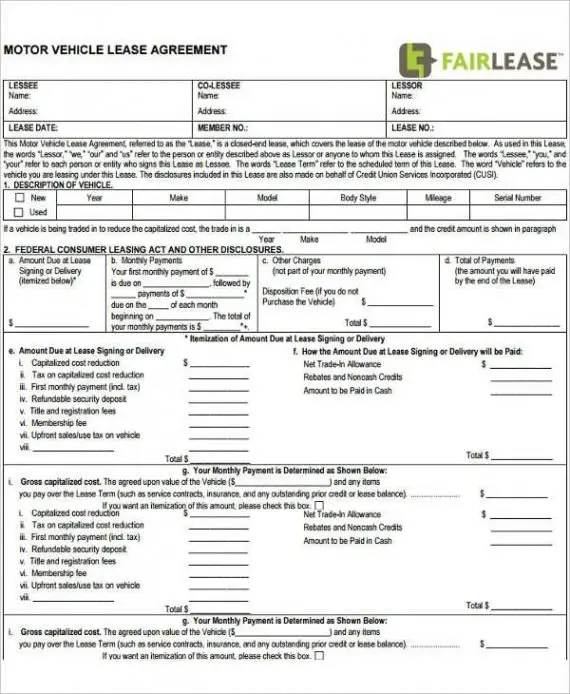

When navigating the complexities of car leasing, it is critical to comprehend the key terms and conditions that govern a lease agreement. Car leasing arrangements can offer significant advantages over traditional car finance options, providing lower monthly payments and the opportunity to drive a new vehicle without the long-term commitment of ownership. However, a thorough understanding of the lease’s fine print is vital before signing the contract.

One of the essential components of a lease is the lease term, which refers to the duration of the leasing agreement. Typically, lease terms range from two to four years, and the length can impact your monthly payment. Additionally, it is important to recognize the mileage allowance, which defines the maximum distance you are permitted to drive the vehicle over the lease period. Exceeding this limit may incur substantial fees, making it crucial to estimate your driving needs accurately.

Another vital term is the residual value. This figure represents the car’s estimated worth at the end of the lease term and is essential for understanding your potential end-of-lease options. A higher residual value can lead to lower monthly payments, benefiting the lessee. On the other hand, understanding the money factor, akin to the interest rate on a loan, is equally important. This number helps to determine the overall cost of financing the vehicle through leasing.

Moreover, consumers should be aware of fees associated with vehicle leasing, including acquisition fees, disposition fees, and early termination penalties. These costs can add up, so having a clear grasp on them before finalizing any agreement is essential. By establishing familiarity with these terms and conditions, potential lessees can make informed decisions, ensuring that their car leasing experience is both beneficial and satisfying.

The Future of Car Leasing: Innovations and Predictions

As we look ahead to the landscape of car leasing beyond 2025, it is evident that significant innovations and changes are on the horizon. One of the standout trends is the potential for more flexible leasing options. Traditional car leasing has comprised set terms and rigid contracts; however, as consumer preferences evolve, the demand for more adaptable solutions is expected to grow. This could include shorter lease durations, the option to swap vehicles throughout the leasing period, or tailored agreements based on individual usage patterns.

Additionally, the emergence of subscription services is anticipated to reshape the vehicle leasing market. Car subscription services allow consumers to access a vehicle for a flat monthly fee, which includes maintenance, insurance, and roadside assistance. This model caters particularly to a younger demographic that values convenience and flexibility, as they may desire to change vehicles frequently without the long-term commitment of traditional car finance agreements. As these subscription models become more mainstream, they may well challenge traditional car leasing practices.

Technological advancements, particularly in autonomous driving, hold significant promise for the future of vehicle leasing. With the rise of self-driving cars, the concept of ownership may be redefined, influencing how consumers engage with car leasing. Companies could offer leasing agreements that include autonomous vehicle fleets, allowing clients to access self-driving vehicles as needed. This represents a noteworthy shift in mobility solutions that can potentially lower costs associated with ownership while enhancing accessibility.

In conclusion, as we move toward 2025 and beyond, car leasing is poised for transformation, characterized by flexibility, innovation, and technology-driven solutions that address the evolving needs of consumers.

Tips for Choosing the Right Lease

When it comes to car leasing, selecting the right lease can significantly influence your driving experience and financial well-being. Begin by conducting thorough research on different leasing companies. Look for firms with positive customer reviews and a trustworthy reputation. Financial health and leasing offers should be your primary focus. Ensure you consider not only the monthly payments but also any hidden fees that might apply. Reputable companies will be transparent about their terms and conditions, making them easier to compare.

Next, when it comes to selecting the vehicle itself, consider your lifestyle and driving needs. Factors such as family size, commuting distance, and preferred vehicle type are crucial. If you frequently travel long distances, it may be wise to choose a vehicle with excellent fuel efficiency. Additionally, examine the lease terms related to mileage. Many contracts have specific mileage limits that can lead to costly overage fees if exceeded. Ensure that the arrangement aligns with your driving habits.

Negotiating better lease terms is also vital in the car finance process. Approach the dealership or leasing agent armed with information about competing offers; this will provide you with leverage during negotiations. Discuss potential discounts or incentives that could reduce your payments or initial costs. Lease terms should include more than just monthly payments; inquire about the maintenance package and end-of-lease options as well. Being proactive in negotiations can lead to a more favorable lease agreement, ultimately enhancing your overall leasing experience.

With these tips in mind, consumers can better navigate the complex world of vehicle leasing, ensuring they select a lease that aligns with both their financial objectives and personal preferences.

Conclusion: Is Car Leasing Right for You?

Car leasing has become a popular alternative to traditional vehicle ownership, offering numerous benefits such as lower monthly payments, access to newer car models, and minimal maintenance costs. However, determining whether car leasing is the right choice for you involves careful consideration of your lifestyle, financial situation, and personal preferences. Throughout this blog post, we explored various aspects of car leasing, including its advantages, potential drawbacks, and how it compares to purchasing a vehicle outright.

One of the main advantages of vehicle leasing is the ability to drive a new car every few years without the burden of long-term ownership. This is particularly appealing for those who enjoy having the latest technology and features. Additionally, car finance options in leasing often require lower upfront costs, making it a budget-friendly solution for many. However, it is essential to consider the limitations associated with leasing, including mileage restrictions and the potential for additional fees at the end of the lease term.

As you reflect on whether car leasing fits your needs, consider factors such as your driving habits, financial goals, and how much you value flexibility in your transportation options. Understanding the terms and conditions of a lease agreement is crucial, as these can impact your overall experience. It is advisable to conduct thorough research on different leasing programs, rates, and associated costs before deciding. Consulting with a financial advisor may also provide clarity on how leasing aligns with your overall financial strategy. In conclusion, weighing the pros and cons of car leasing against personal priorities will enable you to make an informed decision tailored to your circumstances.