The automotive landscape we know today wasn’t built by solo pioneers working in isolation. It emerged through calculated mergers and strategic consolidations that transformed small car companies into industrial behemoths. Many of today’s automotive giants were born through a series of mergers that reshaped the entire industry, with companies like General Motors establishing dominance by bringing Buick, Oldsmobile, and other manufacturers under one corporate umbrella as early as 1908.

The merger trend has continued throughout automotive history, though not every attempted consolidation succeeded. In 1916, William C. Durant and associates tried to create a massive auto conglomerate, but the deal collapsed despite significant momentum. This pattern of attempted consolidations, successful mergers, and occasional failures demonstrates how the automobile industry has constantly sought efficiency and market dominance through strategic partnerships.

Key Takeaways

- The largest automotive companies were created through strategic mergers that combined resources, technology, and market reach.

- Economic pressures and technological changes have repeatedly driven waves of consolidation throughout the automobile industry’s history.

- Modern automotive mergers increasingly focus on gaining competitive advantages in electrification and developing new market opportunities.

Historical Overview of the Auto Industry

The American automotive industry’s development was shaped by bold business moves, strategic acquisitions, and fierce competition that eventually consolidated power among a few dominant companies.

The Inception of Mergers and Acquisitions

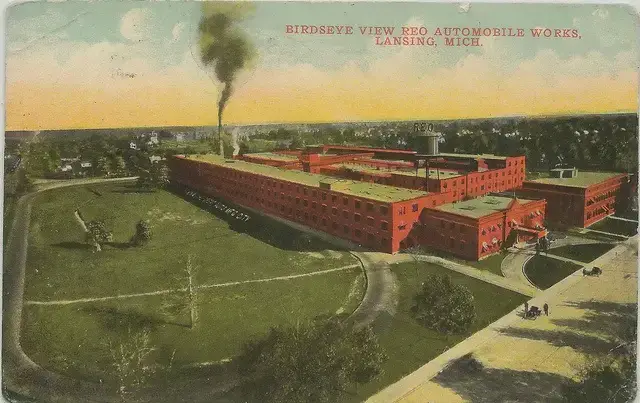

The U.S. automotive industry began in the 1890s, quickly growing due to America’s large domestic market and adoption of mass production techniques. Early pioneers like Ransom E. Olds established the first successful auto manufacturing companies, with Olds’ assembly line concepts predating even Ford’s famous implementation.

By the early 1900s, hundreds of small car manufacturers competed in a fragmented market. This environment created perfect conditions for consolidation, as stronger companies began purchasing smaller competitors to acquire their technology, manufacturing capacity, and market share.

The first significant merger occurred when William Durant formed General Motors in 1908 by combining Buick with several smaller manufacturers. This move established the blueprint for future automotive consolidations.

Major Players of the Early 20th Century

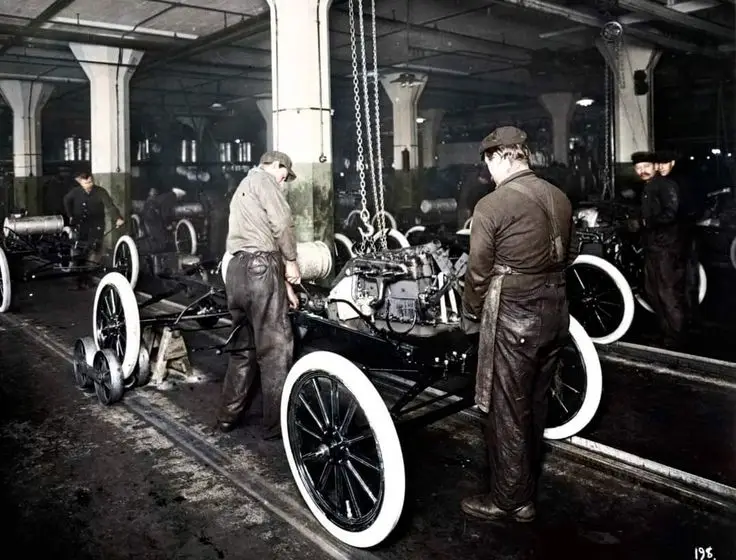

Ford Motor Company, established by Henry Ford in 1903, resisted the early merger trend. Instead, Ford focused on manufacturing efficiency and created the Model T, which revolutionized car affordability through standardization and assembly line production.

General Motors continued aggressive expansion under Durant’s leadership, acquiring Cadillac, Oldsmobile, and Oakland (later Pontiac). These strategic acquisitions positioned GM to offer vehicles across multiple price points, establishing the “ladder of consumption” marketing strategy.

Walter Chrysler entered the industry after leaving General Motors, purchasing the Maxwell Motor Company in 1925 and rebranding it as Chrysler Corporation. Chrysler further expanded by creating the Plymouth and DeSoto brands, and by acquiring Dodge Brothers in 1928.

These three companies—Ford, GM, and Chrysler—would eventually become known as the “Big Three” American automakers.

The Pre-war Consolidation Movement

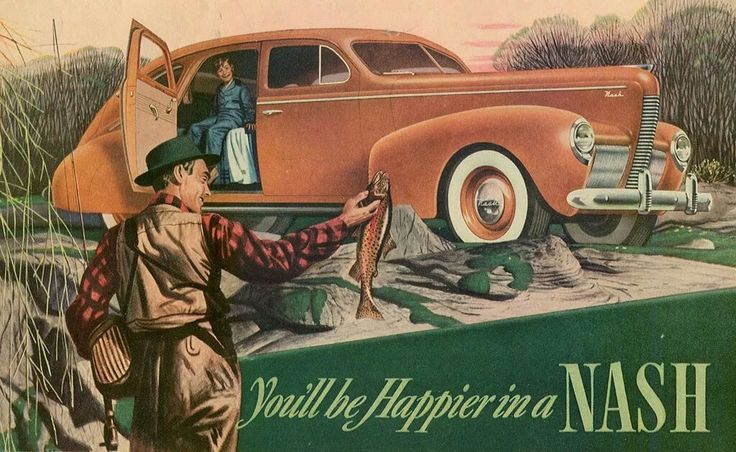

The 1920s and early 1930s saw accelerated industry consolidation as economic pressures forced many smaller manufacturers to merge or close. Premium brands like Packard and Studebaker competed effectively during this period but would later struggle against the economies of scale achieved by larger competitors.

In 1928, Chrysler reorganized its product lineup, creating Plymouth for economy cars and DeSoto for mid-priced vehicles. This restructuring helped Chrysler weather the Great Depression better than many competitors.

A significant merger attempt occurred in 1916 when William Durant and John North Willys tried to create a massive automotive conglomerate, but the deal ultimately collapsed. Had it succeeded, it would have dramatically altered the industry’s competitive landscape.

By the late 1930s, the American automotive landscape had transformed from hundreds of manufacturers to a handful of dominant players, setting the stage for the industry’s mid-century golden era.

Post-War Adjustments and Strategy Shifts

The automotive industry underwent dramatic changes after World War II as manufacturers shifted from military production back to civilian vehicles. New market dynamics emerged alongside growing competition both domestically and from foreign automakers.

Birth of the Big Three and Market Dominance

General Motors, Ford, and Chrysler solidified their positions as the “Big Three” in the post-war era. These companies controlled nearly 90% of the American auto market by the 1950s. Their dominance stemmed from wartime manufacturing experience and established assembly line techniques pioneered by Ford’s Model T production decades earlier.

GM led with a multi-brand strategy offering vehicles at various price points. Ford rebuilt its civilian production rapidly, introducing popular models like the 1949 Ford. Chrysler competed through engineering innovations and distinctive styling.

This period saw unprecedented growth in car ownership. The Big Three expanded production capacity and dealership networks while implementing annual model changes to encourage repeat purchases.

Challenges and Responses to Import Competition

By the late 1950s, import competition began challenging American dominance. Volkswagen’s Beetle gained popularity, prompting the Big Three to develop their own compact car market entries. Ford introduced the Falcon, Chevrolet launched the Corvair, and Chrysler released the Valiant.

American Motors (AMC), formed through the 1954 merger of Nash-Kelvinator and Hudson Motor Car Company, focused exclusively on smaller cars. AMC’s strategy initially helped it survive against the Big Three, but limited resources hampered long-term competitiveness.

Rising trade friction appeared by the 1970s as Toyota Motor Co., Ltd and other Japanese manufacturers gained market share. Oil crises in 1973 and 1979 accelerated this shift, with American consumers increasingly preferring fuel-efficient imports.

Detroit’s response included downsizing vehicle lines and mergers and acquisitions to maintain competitive positions. Chrysler faced bankruptcy before securing government loan guarantees in 1979.

Consolidation in the Late 20th and Early 21st Centuries

The automotive industry underwent significant transformation through strategic mergers and acquisitions from the 1980s through the early 2000s. These consolidations redefined the global automotive landscape and created new industrial powerhouses across continents.

Rise of Global Partnerships and Alliances

The late 20th century saw unprecedented consolidation in the automotive sector. In 1998, one of the most notable mergers occurred when Daimler AG acquired Chrysler Corporation for $36 billion, forming DaimlerChrysler AG. This “merger of equals” aimed to create a global automotive powerhouse combining German engineering with American market presence.

The alliance proved challenging, and by 2007, Daimler sold Chrysler to Cerberus Capital Management for $7.4 billion. This failed merger demonstrated how cultural differences and misaligned production philosophies could undermine consolidation efforts.

Other significant partnerships included the Renault-Nissan Alliance formed in 1999, which later expanded to include Mitsubishi. This partnership successfully shared platforms, technology, and economic resources while maintaining distinct brand identities.

The 2000s also saw Ford increase its stake in Mazda, while General Motors formed partnerships with Suzuki, Subaru, and Isuzu to gain access to Asian markets and share development costs.

Impact of Cross-Continental Mergers

Cross-continental mergers fundamentally reshaped automotive capital flows and production strategies. The 2014 formation of Fiat Chrysler Automobiles (FCA) represented a true transatlantic integration combining Italian and American automotive traditions.

FCA’s creation allowed for shared platforms, engines, and technology across brands like Jeep, Dodge, Fiat, and Alfa Romeo. This consolidation helped save approximately $4.5 billion in development costs between 2014-2018.

The most recent major consolidation occurred in 2021 when FCA merged with French PSA Group (Peugeot, Citroën) to form Stellantis. This merger created the world’s fourth-largest automaker with 14 brands under one corporate umbrella.

Chinese manufacturers also emerged as consolidation players, with Geely purchasing Sweden’s Volvo from Ford in 2010 for $1.8 billion. This acquisition transferred technological expertise while opening Western markets to Chinese capital.

These cross-border mergers created more resilient companies able to weather economic downturns by diversifying production across multiple markets and regulatory environments.

The Era of Electrification and New Markets

The automotive industry is undergoing a profound transformation as companies navigate the shift toward electric vehicles and changing consumer preferences. Major manufacturers are forming strategic partnerships to share costs and accelerate innovation.

Strategic Consolidations for Electric Vehicle Production

Traditional automakers are increasingly joining forces to develop electric vehicle technology. Ford Motor has formed partnerships with startups and tech companies to expand its EV capabilities. The company invested heavily in Rivian before changing course to focus on its own electric platforms.

General Motors committed billions to electric vehicle development, announcing plans to be all-electric by 2035. Their strategy includes partnerships with battery manufacturers and charging infrastructure companies to create a complete ecosystem.

The shift to electric vehicles is driving a new wave of industry consolidation. Traditional competitors now collaborate on shared EV platforms to distribute the enormous development costs. According to analysts, this trend may lead to automotive consolidation among existing manufacturers.

Chinese EV manufacturers are also expanding globally, forcing Western automakers to consider mergers to maintain competitiveness.

Adjusting to Evolving Consumer Demand

Consumer preferences have shifted dramatically toward SUVs and crossovers. Brands like Jeep have experienced renewed popularity, making them valuable acquisition targets. After changing hands multiple times, Jeep now operates under Stellantis, formed by the merger of FCA and PSA Group.

Automakers are consolidating to meet changing market demands for technology-rich vehicles. Modern cars require sophisticated software and electronics, prompting partnerships between traditional manufacturers and tech companies.

The popularity of ride-sharing and subscription services has further pushed manufacturers to rethink business models. Some companies merge to create mobility service platforms rather than just selling vehicles.

Regional market shifts also drive consolidation. As growth slows in traditional markets, companies form alliances to enter emerging markets with locally relevant products and expand their competitiveness globally.

Operational Synergy and Technological Advancements

When automotive giants merge, they gain powerful advantages in production efficiency and innovation capabilities. These benefits transform how cars are made and sold while accelerating technological progress throughout the industry.

Streamlining Production and Sales

Auto industry mergers create significant operational synergies by combining manufacturing facilities and supply chains. Companies can eliminate duplicate factories and consolidate production lines, reducing costs by 15-30% in many cases.

For example, when Fiat merged with Chrysler, they integrated their vehicle platforms, allowing multiple models to share the same basic architecture. This reduced design costs and improved manufacturing efficiency.

Supply chain integration also yields major benefits. Merged companies gain stronger negotiating power with suppliers, often securing 5-10% price reductions on components. Volkswagen Group demonstrated this by standardizing parts across Audi, Škoda, and SEAT brands.

Distribution networks benefit similarly. Combined dealer networks reduce overhead while expanding market reach. This explains why automotive M&As frequently target synergies in sales and service operations.

Advancing Decision-Making and Innovation

Merged automotive companies create larger R&D teams with broader expertise. This concentration of talent accelerates innovation in electric vehicles, autonomous driving, and connectivity technologies.

The Renault-Nissan-Mitsubishi Alliance demonstrates this effect. Their combined research teams developed shared electric vehicle platforms much faster than each company could have individually. Their pooled resources supported the Nissan Leaf and related models across brands.

Data sharing represents another crucial advantage. Automotive M&As enable companies to combine consumer insights, vehicle performance data, and market trend analysis. This improved information supports better strategic decisions.

Innovation also flows between acquired companies. When Geely purchased Volvo, they gained access to advanced safety technology. Meanwhile, Volvo benefited from Geely’s manufacturing scale and Chinese market expertise. This two-way exchange accelerated product development for both brands.

Modern Challenges and Future Directions

Today’s automotive giants face unprecedented challenges that will shape the industry’s future. From trade tensions to sustainability demands, automakers must adapt their strategies while maintaining competitive positions in rapidly evolving markets.

Navigating Trade Frictions and Market Fluctuations

Global automotive manufacturers increasingly confront significant trade friction between major economies. Tariffs between the US and China have forced companies to reconsider supply chains and manufacturing locations.

The 2018-2020 trade disputes directly impacted profit margins, with some automakers seeing up to 10% cost increases on imported components. These tensions create unpredictable market conditions that complicate long-term planning.

Financial uncertainty requires automotive giants to maintain substantial capital reserves. Toyota Motor Corporation, for instance, held approximately $50 billion in cash reserves entering 2023 to weather potential disruptions.

Currency fluctuations present another challenge. When the yen strengthens, Japanese exports become less competitive, forcing companies like Toyota Motor Sales Co., Ltd to adjust pricing strategies.

Overseas Strategies and Emerging Markets

Automotive consolidation has shifted toward strategic partnerships rather than complete mergers. These arrangements allow companies to share technology costs while maintaining brand independence.

India and Southeast Asia represent crucial growth markets. Manufacturers are developing market-specific vehicles that balance affordability with local preferences.

Overseas strategy now emphasizes local production to avoid tariffs and reduce shipping costs. Volkswagen’s expansion in China exemplifies this approach, with dedicated Chinese design centers creating region-specific models.

Joint ventures remain the preferred entry method for restricted markets. These partnerships provide valuable local market knowledge and help navigate regulatory requirements.

Digital sales channels are transforming distribution models. Online purchasing options now complement traditional dealership networks, especially in tech-savvy markets.

Sustainable Growth in a Competitive Landscape

Intense competition drives innovation across all segments. The electric vehicle transition has created opportunities for both established players and newcomers like Tesla and BYD.

Resource management and innovation capacity have become critical success factors. Automakers must balance immediate profitability with long-term sustainability investments.

Environmental regulations increasingly shape product development. The EU’s carbon emission targets have accelerated electric vehicle adoption, with manufacturers facing heavy fines for non-compliance.

Autonomous driving technology presents both opportunity and challenge. The massive R&D investments required have driven unusual collaborations between traditional competitors.

Workforce transformation remains essential as manufacturing becomes more automated. Companies must retrain employees while attracting new talent with digital skills.

Crucial Mergers and Acquisitions Case Studies

The automotive industry has been shaped by strategic mergers that transformed small manufacturers into global powerhouses. These consolidations created new corporate entities while preserving iconic brands and expanding market reach across continents.

The Formation of DaimlerChrysler AG

In 1998, German luxury automaker Daimler-Benz and American manufacturer Chrysler Corporation completed a historic $36 billion merger through a stock swap. This created DaimlerChrysler AG, then the world’s fifth-largest automaker. The deal was initially marketed as a “merger of equals,” though it later became apparent Daimler had effectively acquired Chrysler.

The merger aimed to combine Daimler’s engineering expertise with Chrysler’s manufacturing efficiency and North American market presence. It also absorbed American Motors Corporation (AMC), which Chrysler had previously acquired in 1987.

Despite ambitious production goals, cultural differences between the German and American operations created significant integration challenges. By 2007, Daimler sold its Chrysler division to Cerberus Capital Management, ending what many industry analysts consider a cautionary tale in automotive mergers.

Fiat Chrysler Automobiles’ Strategic Alliances

Following Chrysler’s financial struggles during the 2008 recession, Italian automaker Fiat acquired a 20% stake in Chrysler in 2009. By 2014, this partnership evolved into a complete merger creating Fiat Chrysler Automobiles (FCA).

The merger proved more successful than the DaimlerChrysler experiment, with CEO Sergio Marchionne implementing cross-platform sharing between brands like Jeep, Dodge, Fiat, and Alfa Romeo. This integration streamlined production costs while preserving brand identities.

FCA’s formation exemplifies how proper pre-acquisition and post-acquisition processes contribute to M&A success in the automotive industry. The company later pursued further consolidation, merging with PSA Group in 2021 to form Stellantis, currently the world’s fourth-largest automaker.

Toyota’s Global Expansion and MOUs

Toyota Motor Co., Ltd followed a different expansion strategy than Western competitors, preferring strategic alliances and memorandums of understanding (MOUs) over full mergers.

Under the leadership of Shoichiro Toyoda (chairman 1992-1999), Toyota established joint production ventures with General Motors (NUMMI in California) and partnerships with smaller manufacturers like Subaru and Mazda.

Toyota’s careful approach to expansion emphasized maintaining quality control and corporate culture. Instead of quick acquisitions, the company signed targeted MOUs to gain manufacturing footprints in new markets and access to complementary technologies.

This methodical strategy helped Toyota become the world’s largest automaker by 2008, demonstrating that strategic alignment can be achieved through partnerships that fall short of full mergers while still driving global growth.

Frequently Asked Questions

The automotive industry’s landscape has been shaped by key mergers that created today’s major manufacturers. These consolidations happened for various reasons including financial necessity, strategic expansion, and technological advancement.

What are some notable examples of mergers within the automotive industry that created major players?

Ford’s acquisition of Volvo in 1999 represented a significant move to expand its luxury vehicle portfolio. The deal valued at $6.45 billion helped Ford compete in the premium segment.

General Motors built its empire through numerous acquisitions including Chevrolet, Cadillac, and Pontiac in the early 20th century. These mergers created one of the largest automotive conglomerates in history.

The Renault-Nissan Alliance formed in 1999 created a powerful global partnership without a complete merger. This arrangement allowed both companies to maintain their identities while sharing technology and resources.

What led to the failure of the Daimler-Chrysler merger?

Cultural differences between the German and American companies created significant operational challenges. Daimler’s engineering-focused approach clashed with Chrysler’s market-driven strategy.

Financial expectations were not met as synergies failed to materialize. The “merger of equals” quickly became perceived as a Daimler takeover, causing resentment among Chrysler executives.

Market timing also played a role, as economic downturns impacted Chrysler’s performance. By 2007, Daimler sold Chrysler to Cerberus Capital Management for $7.4 billion, far less than the original merger value.

How did the Stellantis company come into existence through industry consolidation?

Stellantis formed in January 2021 through the merger of Fiat Chrysler Automobiles (FCA) and the PSA Group. This created the world’s fourth-largest automaker by volume.

The merger brought together iconic brands including Jeep, Ram, Peugeot, Citroën, and Alfa Romeo. The $52 billion deal aimed to achieve economies of scale and enhance competitiveness in electric vehicles.

Both companies had histories of previous mergers, with FCA itself being the result of Fiat’s acquisition of Chrysler following the 2008 financial crisis.

What are the long-term impacts on the automobile market following significant mergers?

Reduced competition often leads to fewer choices for consumers but potentially better economies of scale. Large conglomerates can invest more in research and development, accelerating technological innovation.

Brand identity challenges frequently emerge as companies balance maintaining heritage with corporate integration. Some acquired brands maintain their distinct character while others are gradually homogenized.

Employment impacts vary, with initial job cuts during consolidation often followed by workforce stability if the merger succeeds. Regional economic effects can be significant when production facilities are consolidated.

Which merger in the automotive sector is considered the most successful and why?

The Renault-Nissan-Mitsubishi Alliance is widely regarded as successful due to its longevity and financial results. While not a traditional merger, this strategic partnership has survived over 20 years while maintaining brand identities.

Volkswagen’s acquisition of Audi, SEAT, and Škoda transformed the company into Europe’s largest automaker. VW successfully positioned these brands at different market segments while sharing platforms and technology.

Toyota’s gradual acquisition of stakes in smaller Japanese manufacturers like Daihatsu and Subaru has proven effective. This approach allowed Toyota to expand its reach while maintaining the unique attributes of each brand.

What are the primary factors driving mergers and acquisitions in the automotive industry?

Cost reduction through economies of scale is a major motivator, particularly as critical success factors in automotive M&As include efficient integration. Shared platforms, purchasing power, and manufacturing facilities significantly reduce per-unit costs.

Access to new technologies, especially for electrification and autonomous driving, drives many recent deals. Traditional automakers often acquire tech startups to gain expertise in these emerging areas.

Market access considerations push companies to merge for geographic expansion. This allows them to enter new regions without building distribution networks from scratch.

Regulatory pressures around emissions and safety standards encourage consolidation. Larger companies can better absorb the high costs of compliance with increasingly strict regulations.